Protect Your Business

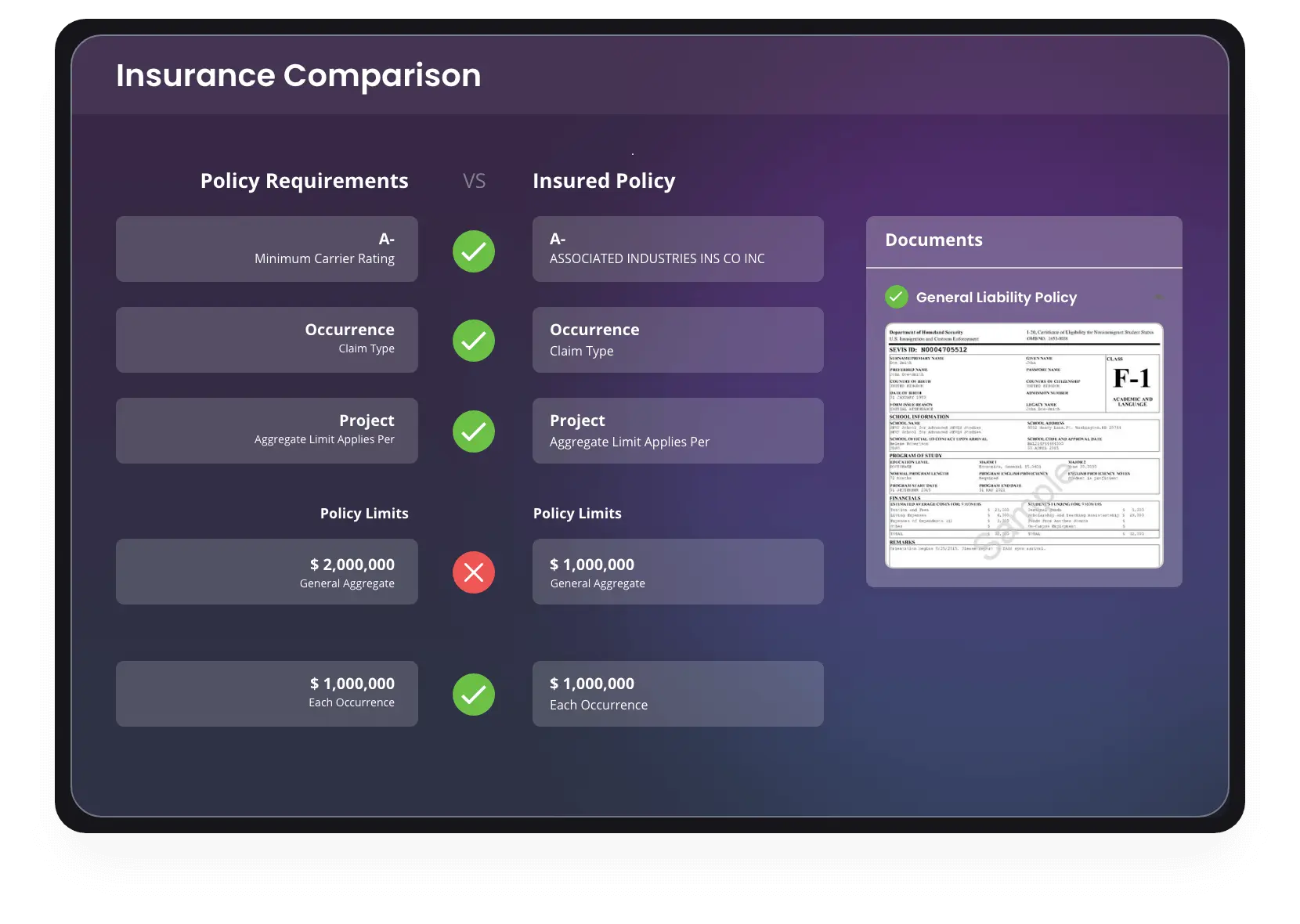

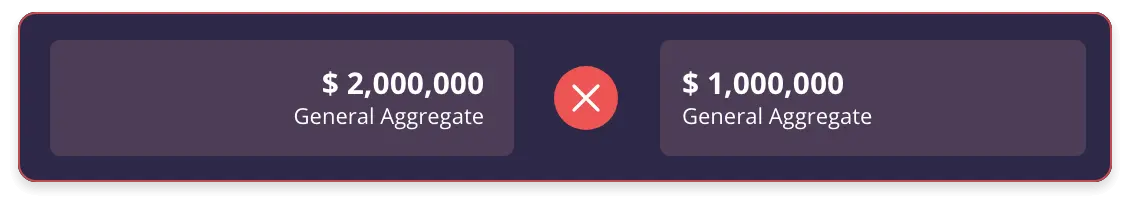

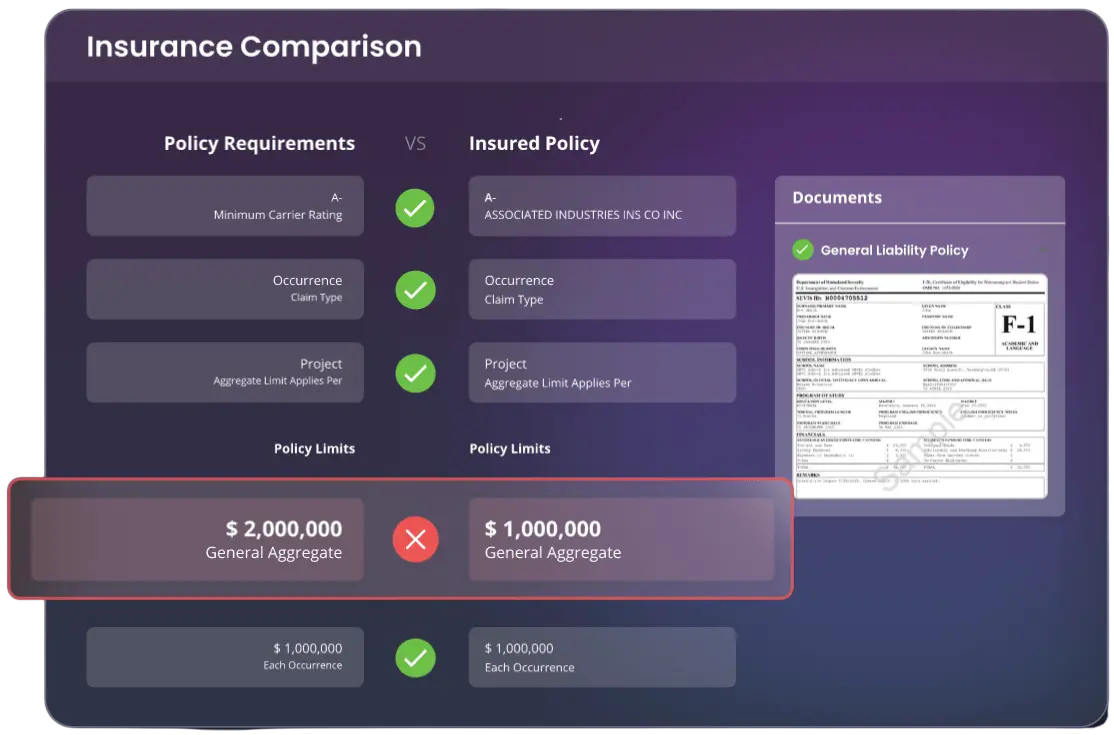

Manually tracking COIs is an error-prone process that puts businesses at risk. AI powered insurance verification reduces liabilities from errors and automatically identifies hidden risks for you.

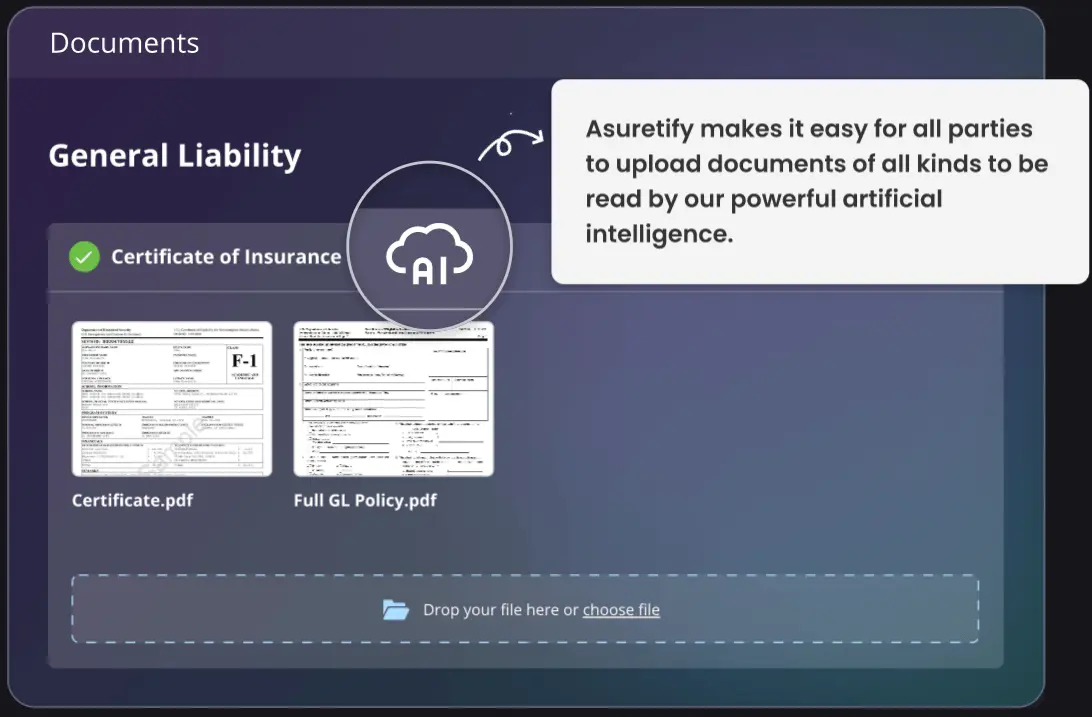

Asuretify avoids project delays and lost revenue because it analyzes entire policies, endorsements, and COIs in just 60 seconds.

Schedule Your Consultation

Faster Verification | Increased Compliance | Confident Accuracy

Manually tracking COIs is an error-prone process that puts businesses at risk. AI powered insurance verification reduces liabilities from errors and automatically identifies hidden risks for you.

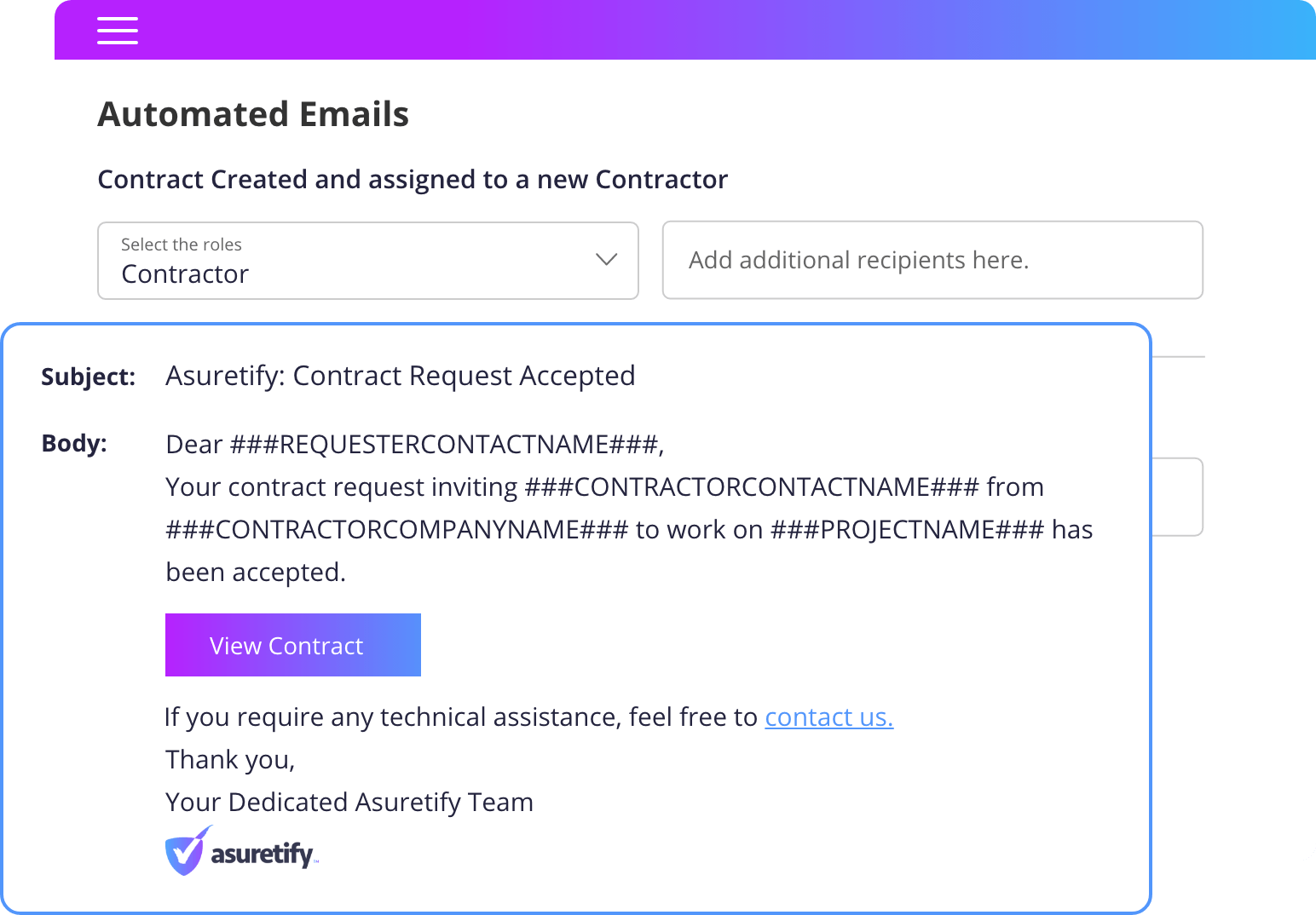

Is your staff overwhelmed or spending too much time manually tracking COIs? AI powered insurance verification reduces liabilities from errors and hidden risks, but it will also improve staff productivity. They won’t miss the manual tasks, and you’ll be the hero.

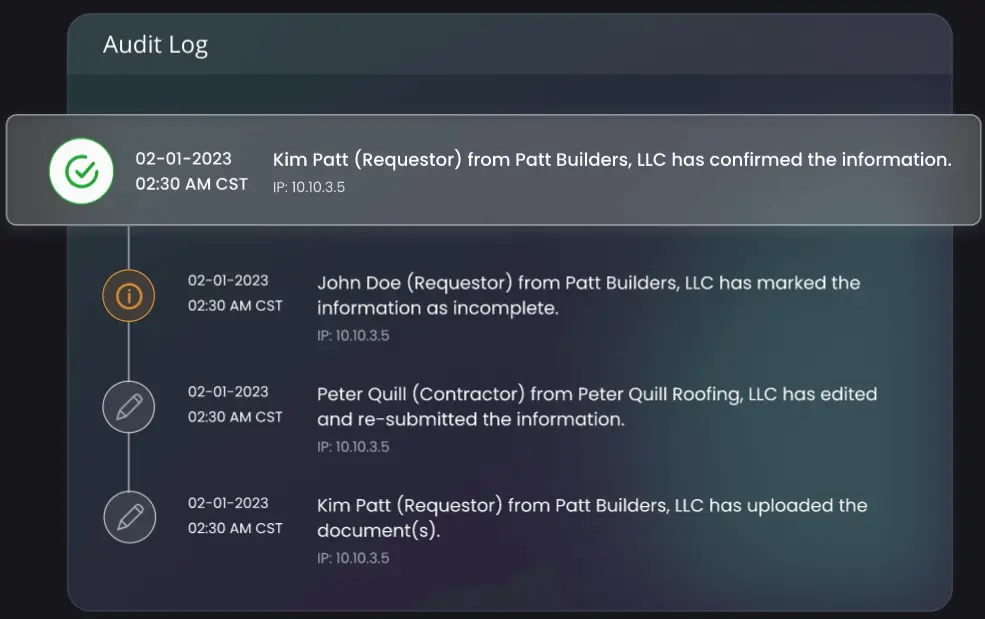

Things are missed and mistakes are made…especially when the processes and tasks are manual. Not so with automated insurance verification software. Protect yourself from liabilities and avoid legal issues with a comprehensive audit trail.

Automating your insurance compliance is not about replacing people. It will reduce staff burnout and churn, unleashing them to work on other things and improve your bottom line.

Manually tracking COIs is an error-prone process that puts businesses at risk. AI powered insurance verification reduces liabilities from errors and automatically identifies hidden risks for you.

Is your staff overwhelmed or spending too much time manually tracking COIs? AI powered insurance verification reduces liabilities from errors and hidden risks, but it will also improve staff productivity. They won’t miss the manual tasks, and you’ll be the hero.

Things are missed and mistakes are made…especially when the processes and tasks are manual. Not so with automated insurance verification software. Protect yourself from liabilities and avoid legal issues with a comprehensive audit trail.

Automating your insurance compliance is not about replacing people. It will reduce staff burnout and churn, unleashing them to work on other things and improve your bottom line.