Save one hour on average per compliance review because Asuretify analyzes entire policies, endorsements, and COIs in just 60 seconds for you.

Faster Verification | Increased Compliance | Confident Accuracy

Save one hour on average per compliance review because Asuretify analyzes entire policies, endorsements, and COIs in just 60 seconds for you.

Automation = less burnout and churn. Unleash your staff to work on other things and improve your bottom line.

Any lack of legal knowledge and the amount of time it takes to manually review endorsements is no longer a concern.

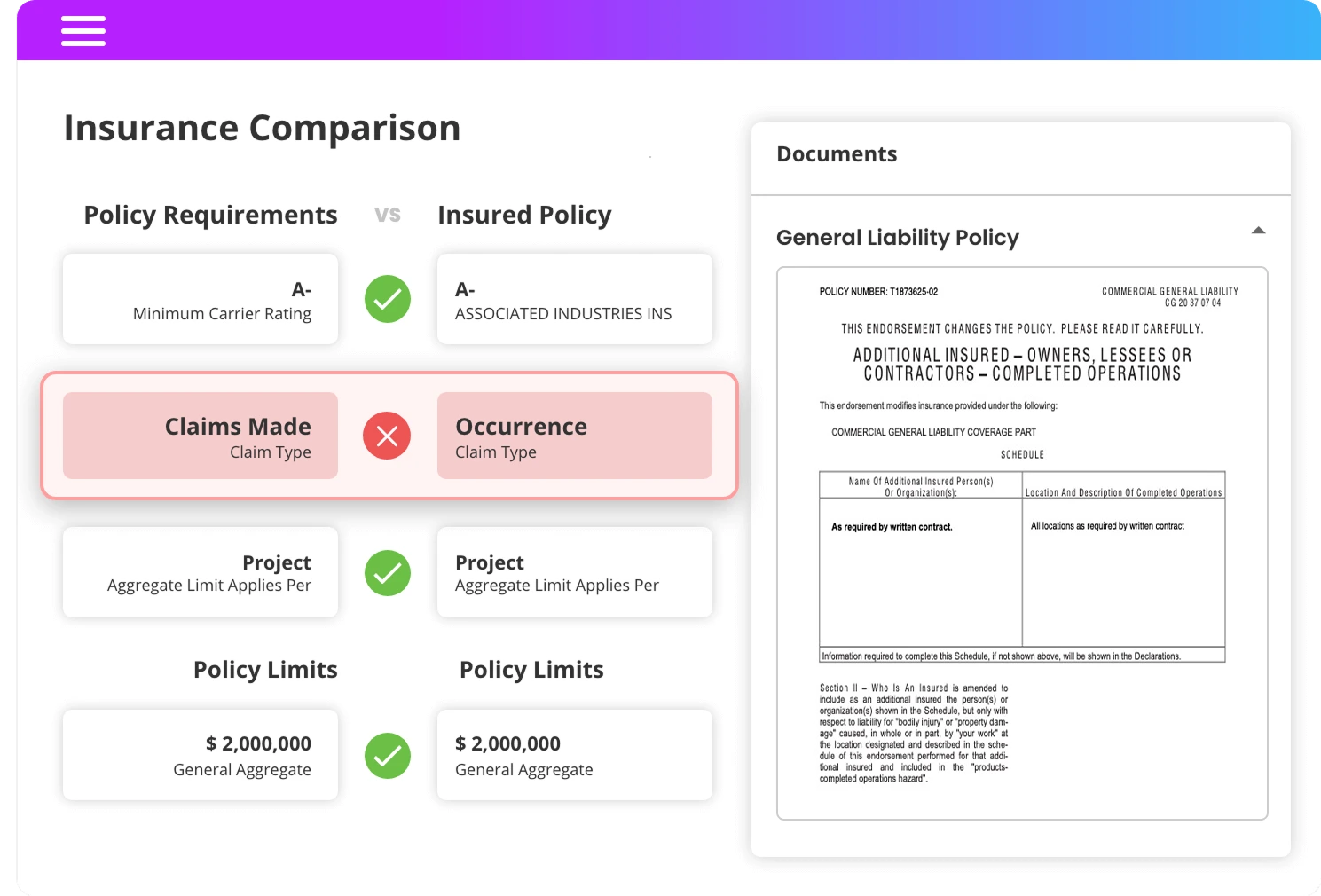

When you identify areas of concern, simply show agents and vendors the compliance issues visually rather than providing explanations of what is required.

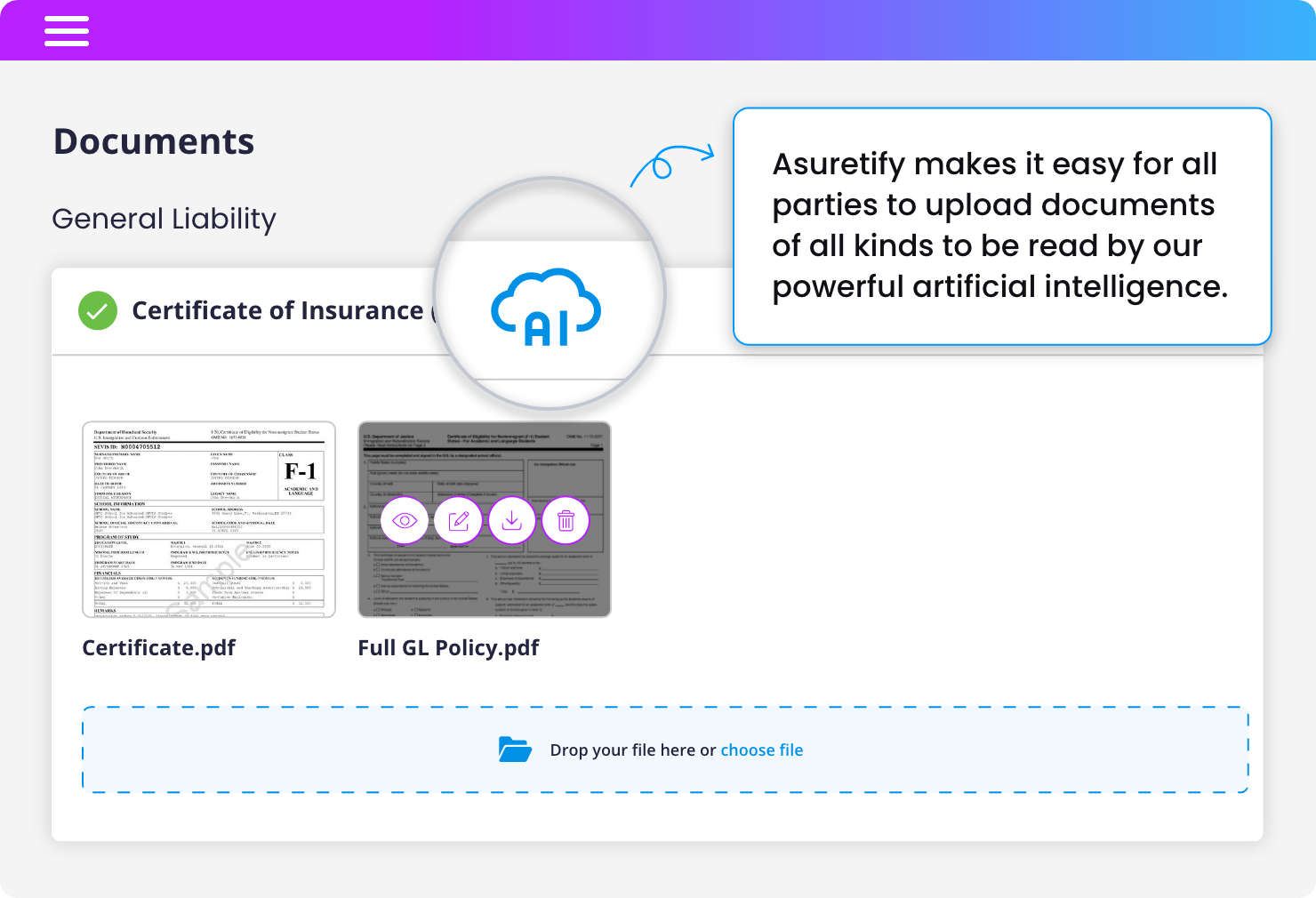

All documents are collected the same way and stored in one place, removing your manual paperwork.

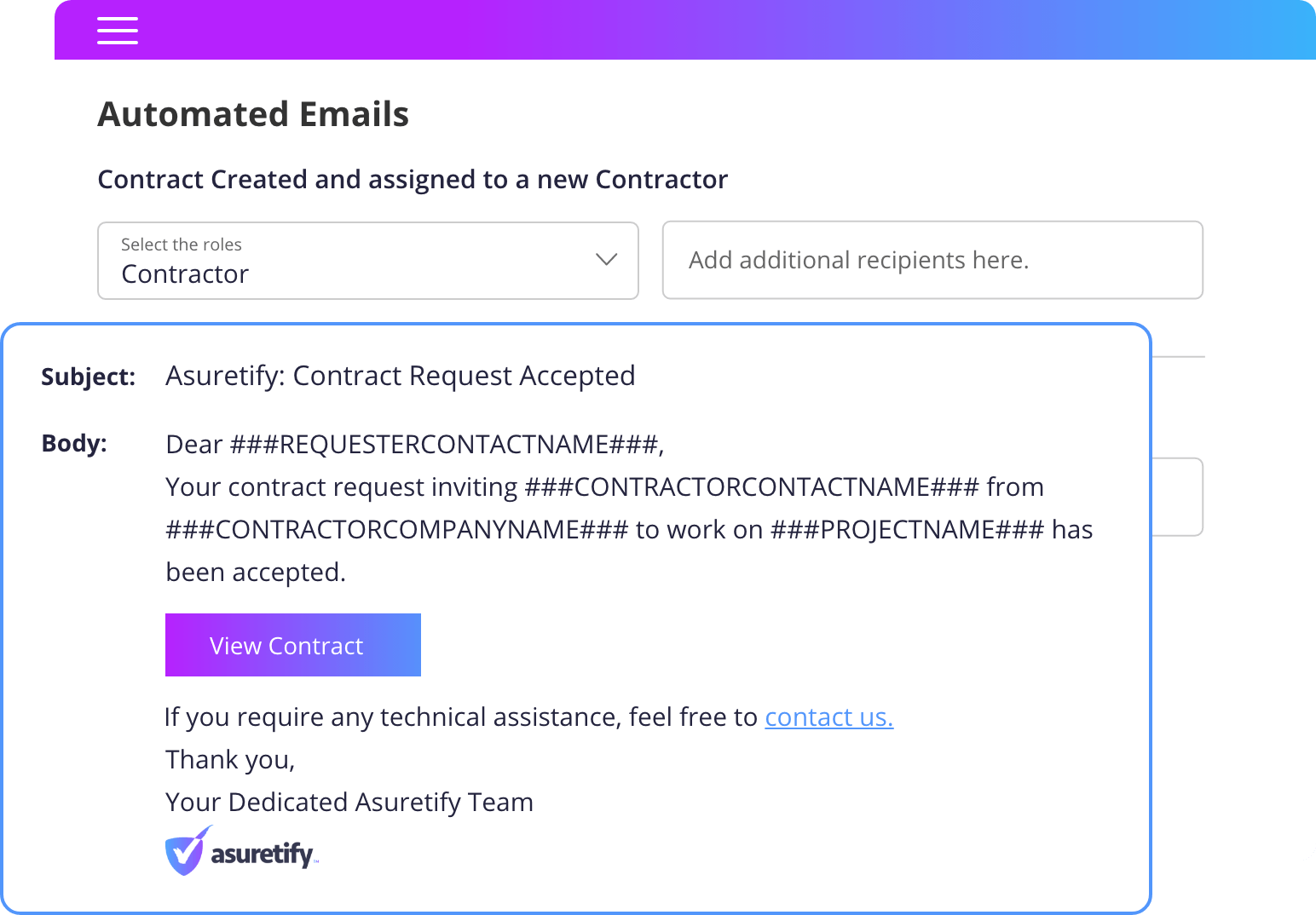

Requests and reminders are sent automatically so you don’t have to repeatedly ask for documents.

Unreliable data, manual entry, and the blame game from “lost” COI requests…all problems of the past.

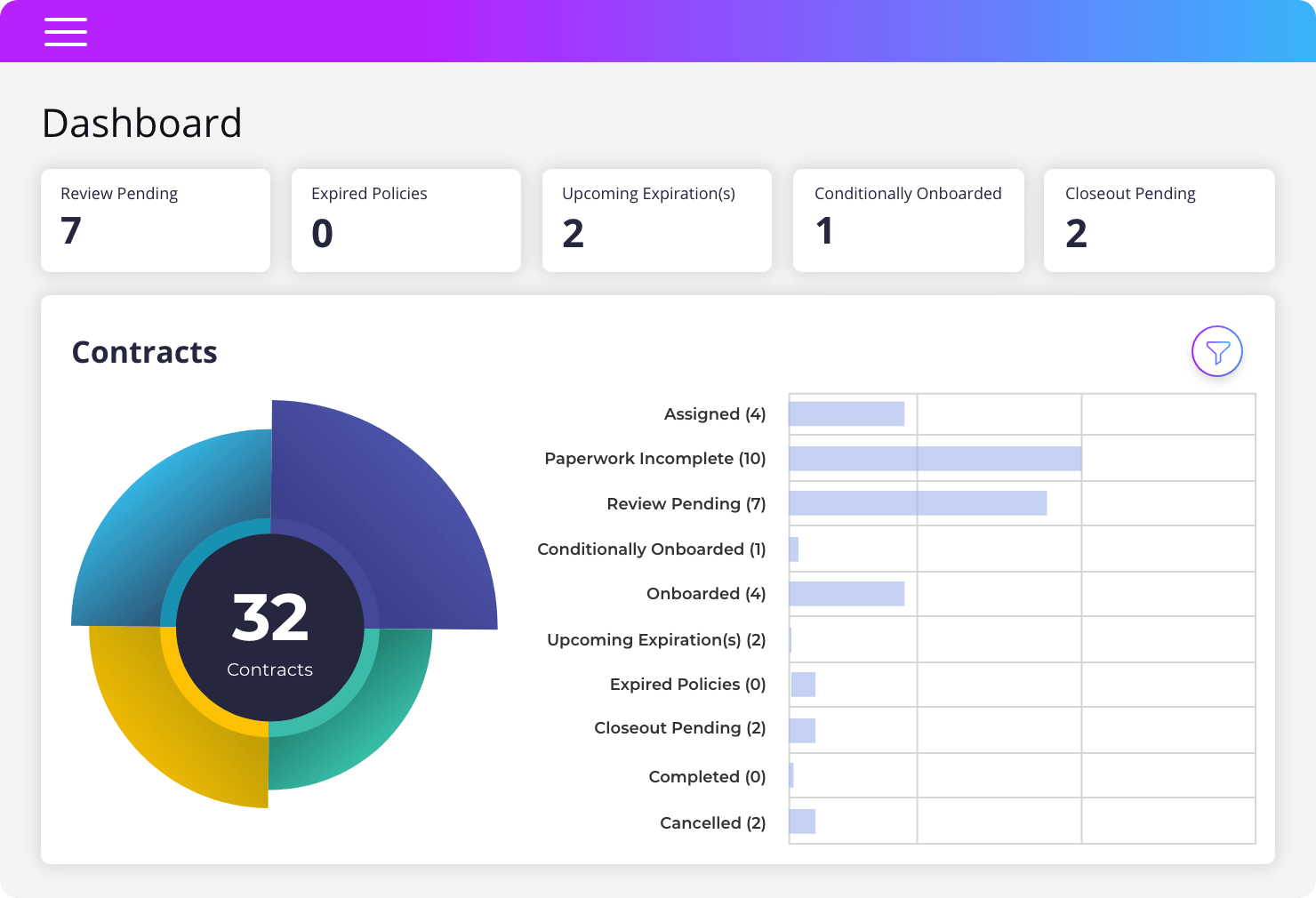

The real-time policy review and dashboard analytics eliminate “guesstimating” from scattered and hard to find data.

Average response time for verification from start to finish is cut by 50%+, so you get subcontractors on the jobsite faster.

Real-time COI tracking, compliance history, contract status, pipeline value…it’s all at your fingertips.

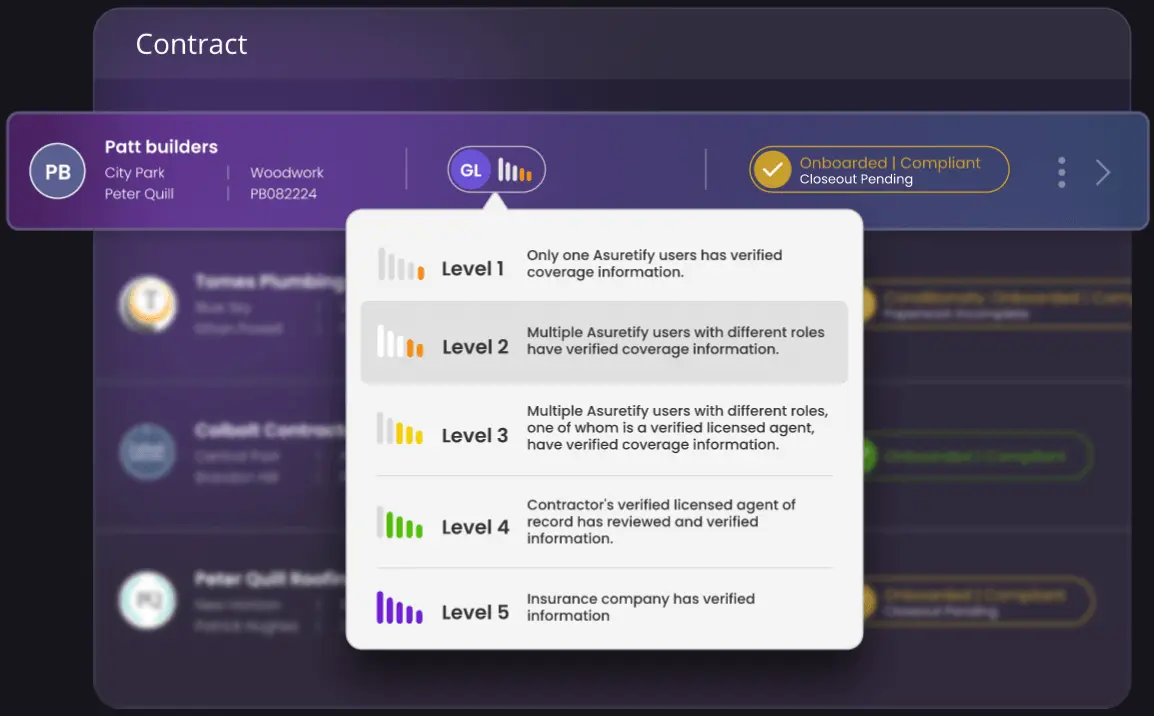

AI powered insurance verification reduces liabilities from manually tracking COIs and automatically identifies hidden risks for you.

With the software platform, you can keep your processes in house and gain even greater control. It’s a win-win for you and your trade partners.

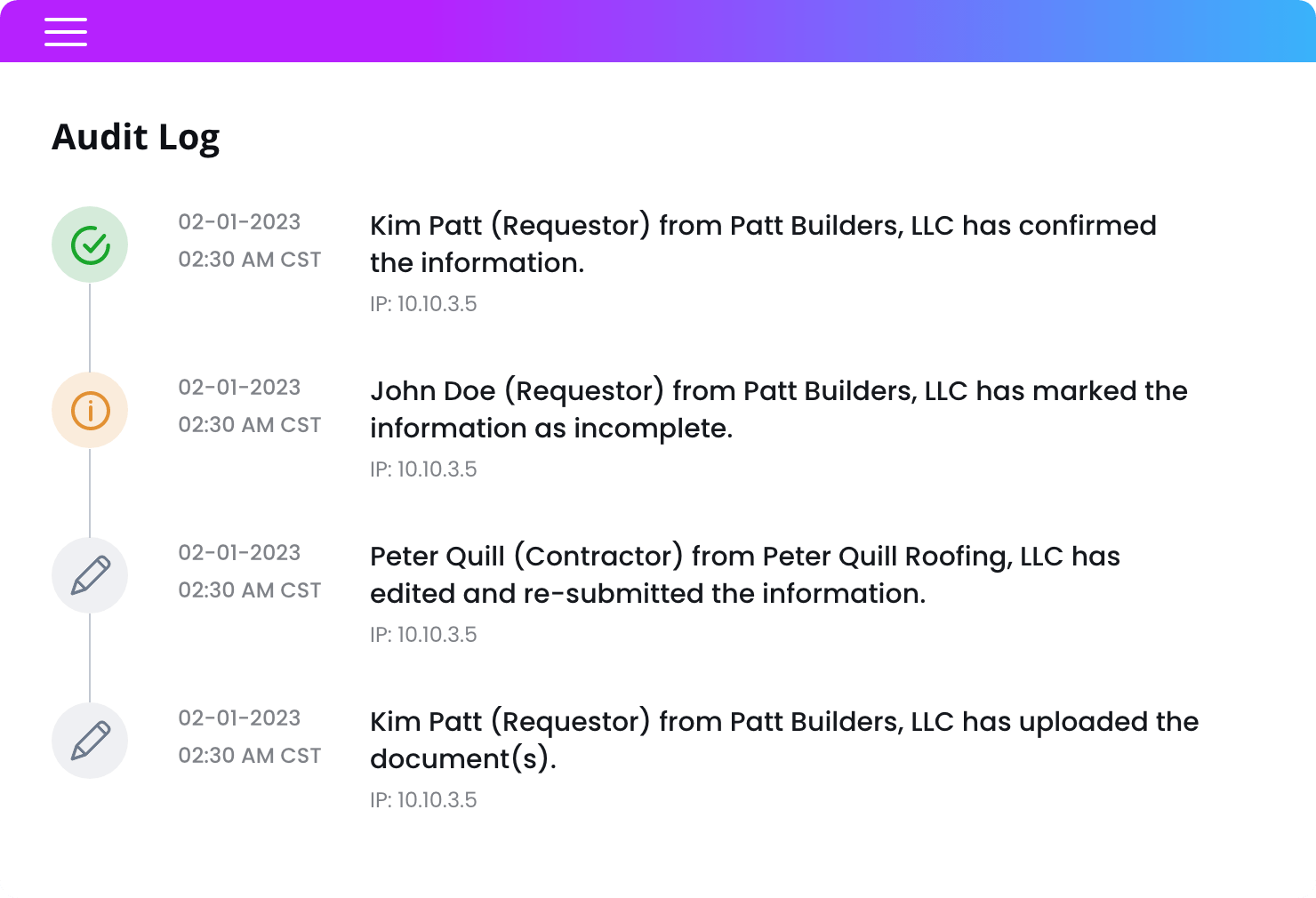

Asuretify records all document uploads and changes, showing you exactly who performed the action and when.

You can have peace of mind knowing that anything that happens after your review can be quickly identified for a legal or financial challenge.

Communication between you and all stakeholders lives in one platform, ending the scattered back-and-forth emails, messages, and texts.

Alerts are sent to all parties ensuring key tasks and dates – such as submissions and insurance renewals – are on everyone’s radar.